The past year has been a low point for the cryptocurrency and web3 sectors. A September 22 report from the crypto analysis company dappGambl found that 95% of all NFTs are essentially worthless. Of an identified 73,257 NFT collections on the market, 69,795 were worth 0 Ethereum. The sell-off of defunct crypto exchange FTX’s assets is driving value down across cryptocurrencies like Bitcoin. Even major brands like Nike have seen their more recent NFTs sell at much lower values than earlier collections.

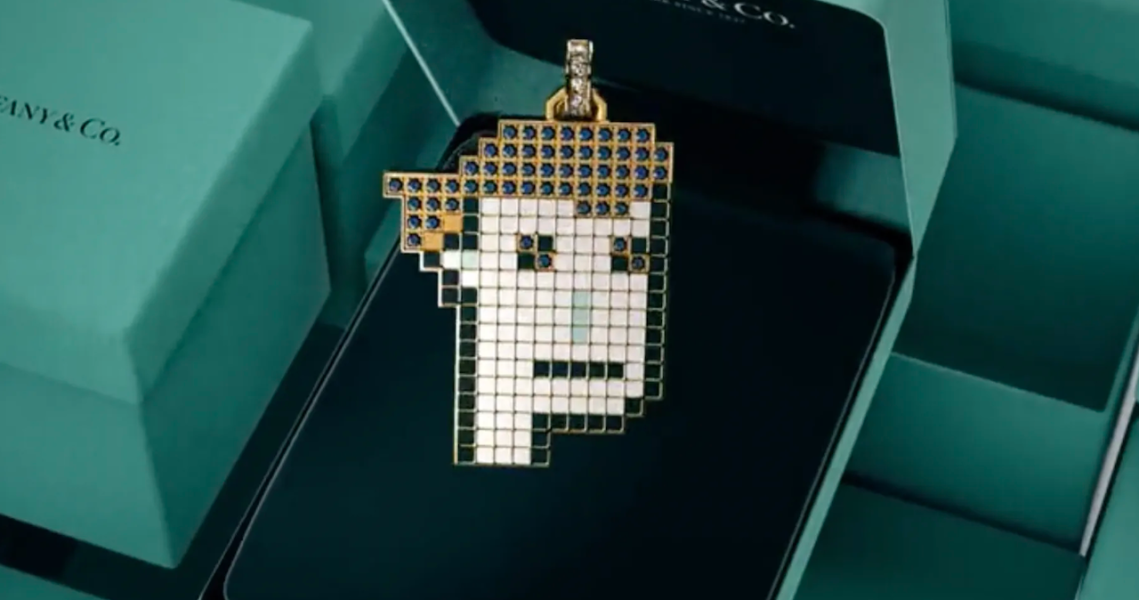

Luxury fashion is one of the sectors still holding tight to the promise of scarce digital goods. But increasingly, these options are not marketed as NFTs alone. Instead, luxury brands are tying them to real products and experiences. Louis Vuitton, under the auspices of Pharrell Williams, released $39,000 trunks over the summer that are both physical and digital goods, while Prada used an NFT as a pass to its Milan Fashion Week show last week.

That’s by design, according to Ian Rogers, the former Apple and LVMH exec who now serves as chief experience officer for the crypto wallet company Ledger. Rogers has a background in both the management of digital goods — he helped launch Apple Music in 2015 — and luxury fashion, as chief digital officer at LVMH from 2015-2020. Ledger’s own products — physical cryptowallet devices that keep cryptocurrency accounts isolated from internet-based hacking attempts — are meant to reduce the volatility inherent to the crypto market. Right now, it’s working on a new device, the Ledger Stax, scheduled for release in the fourth quarter of 2023.

“Right now, every week is a new trading low for NFTs,” Rogers said. “But luxury brands [like LVMH and Dior] have been the most successful because they’re close to creativity. They’re trend-spotters, and they move quick. Nobody buys a luxury watch to tell the time, but they want it as an investment. And it’s the same impetus behind buying a luxury watch as it is to buy an NFT.”

For both Rogers and the CEO of Ledger, Pascal Gauthier, the crash of multiple crypto exchanges and the dwindling value of the majority of NFTs are a sign that the initial hype wave of web3 is dying off so that the real use cases can start to develop.

“The fluff has been burned away,” Rogers said. “What LVMH and the other members of the Aura Blockchain Consortium [a joint non-profit between luxury companies including LVMH, Richemont and Prada Group] are doing with NFTs is not front-page ‘Bored Ape goes to the moon’ kind of stuff. It’s more practical business processes under the surface.”

Gauthier pointed out that Starbucks moved its loyalty program to a blockchain-based system last year. The program’s web3 nature is intentionally obscured from the user and doesn’t require setting up a crypto wallet or anything similar.

“Any brand that is managing CRM can use it, not just luxury brands,” Gauthier said.

The human cost of NFTs’ year-long crash has been significant. Stories of people losing their life savings in bad NFT trades — either through fraud and hacking or simply from investing a lot into an asset that lost all its value — have been common in the crypto world.

But now, a number of new laws are being passed in the U.K. and the U.S. to regulate the industry. New rules like the U.K. Travel Rule require crypto exchanges to collect and share information about cryptocurrency transactions. Meanwhile, in the U.S., a bipartisan bill passed in July to begin building a framework to regulate cryptocurrencies.

Gauthier said it was the excitement and hype of the first wave of NFT projects that led some buyers to financial ruin.

“In a bull market, even some savvy investors forget how to invest,” he said. “Greed leads their decision-making. They thought they could make a lot of money off NFTs, but if it seems too good to be true, it is too good to be true. Regulation, especially of centralized entities, is a no-brainer.”