This week I cover the closure of men’s brand Faculty, which received a $3 million seed funding round in 2021 led by The Estée Lauder Companies and dissolved in August amid a wider, difficult DTC landscape.

Faculty, the once buzzy men’s nail polish brand, is no more.

The brand, which also launched tooth gems in Dec. 2022, dissolved in August. Before this, it had ceased posting on social media in March. Faculty launched in 2019 with three polishes but planned to venture into men’s cosmetic foundation, eye shadow and hair dye at an undetermined time. It generated significant buzz in May 2021 when it raised $3 million in seed funding led by The Estée Lauder Companies’ New Incubation Ventures corporate fund, among others. NIV declined to comment on Faculty’s closure.

Faculty had set out to target third-wave masculine men, or those who feel that masculinity has no real definition and, therefore, the standards for it are nonexistent. Fenton Jagdeo, co-founder of Faculty alongside Umar ElBably, declined to speak on the record regarding why Faculty closed but said he still believes in the men’s beauty category. ElBably did not respond to requests for comment, and his LinkedIn professional history states he left Faculty in May.

“[When] creating cosmetics for this new impression of masculinity, it’s very much about taking the same delivery models that people are used to, when it comes to basic grooming, [like lotions and creams,] and giving them the benefits of cosmetic products,” said Jagdeo.

He added that he believes there is a place for these types of brands that aren’t going after the early beauty adopters, but rather targeting consumers aiming to reflect the zeitgeist. He said, surprisingly, these individuals are not the typical coastal-living people in L.A. and NYC, but are instead more present per capita in states like Nebraska and Ohio.

“What attracted me [to Faculty as an investor] was an insight they shared, which is that when you look at at any male performer on the Top 50 pop chart right now, [almost] every single one of them wears nail polish,” said McKeever “Mac” Conwell, managing partner of RareBreeds VC, a pre-seed venture firm.

There may be an audience for third-wave masculine, gender-neutral or even non-binary brands, but the current DTC environment has made it difficult to operate a newer business successfully. Even before the onset of Covid-19 in 2020, DTC was already in a precarious position due to rising customer-acquisition costs, lower lifetime customer value, expensive digital ad buys, and a prioritization among investors and founders alike on a business being profitable from the start. Young companies are also targets for expensive legal turmoil like Prop 65 and ADA website compliance lawsuits. Countless indie brands have shuttered in the past 15 months, including Lilah B., Aether, Wldkt, Sigial and Vesca Beauty. Men’s grooming brand Disco also shuttered, while men’s skin-care brand Geologie shifted to gender-neutral.

“The indie beauty world has changed so much in the last five to 10 years, between the celebrity-owned brands, the brands that are VC-backed and working with a public figure,” said Laura Kraber, founder of non-binary beauty brand Fluide, which closed in 2022. “Because the product margins are so high in beauty, all the money goes into marketing, and so the stakes are very high.”

As Glossy previously reported, customer acquisition costs can easily skyrocket to around $80 per person, and many DTC brands have moved into wholesale to sustain their growth. According to a survey from Glossy and Modern Retail in Winter 2023, 22% of DTC brands expected to invest “significantly” more in marketing in 2023 compared to the prior year, while 27% said wholesale expansions would “significantly” increase compared to the prior year.

But wholesale is an expensive enterprise. Julian Addo, founder and CEO of Sephora-exclusive hair-care brand Adwoa Beauty, has oft recited her difficult experiences trying to obtain a business loan even with a Sephora purchase order on hand. And venture funding, a common avenue for shoring up liquidity for indie brands, is becoming harder to come by. According to KPMG, citing 2023 data from Pitchbook, the consumer goods and services sector has seen the least number of venture deals closed since 2016 and the smallest amount of venture funding raised. Kraber said that unless a brand focuses on luxury, the margins in DTC e-commerce do not make sense. Faculty’s individual polishes retailed for $17, while the tooth gems starter kit cost $40. Other nail brands targeting men include Harry Styles’s Pleasing, Machine Gun Kelly’s Undn/Laqr and Tyler The Creator’s Golf le Fleur.

“There’s isn’t digital room anymore to bootstrap a beauty brand,” said Kraber. “The last few years have been a transition period where [launching a beauty brand] now takes $5 million to $10 million.”

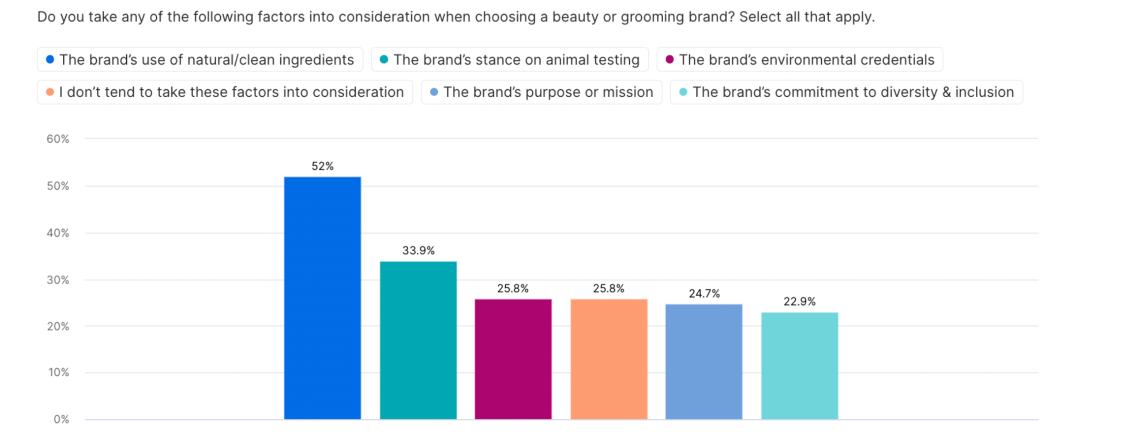

Men’s grooming is also notoriously difficult to crack and has yet to become mainstream for American men. According to a 2022 survey from consumer research platform Attest, 61% of male customers never buy makeup, while 39% buy it regularly. And it’s millennial men who are apparently the biggest customer demo for the category. While 35% of men ages 26-40 shop for makeup once a month, another nearly 50% buy it occasionally. At the same time, American men use no more than three products as part of their daily routine, while women use four to six. So, although men may be interested in a product, the scalability is perhaps lower due to their lower product consumption compared to women. Additionally, all types of customers rank brand values lower in their list of priorities when choosing a brand to buy from, compared to other factors. Only 24.7% of customers in Attest’s survey of 2,000 people considered a brand’s purpose or mission when choosing their beauty or grooming brand, and only 22.9% considered a brand’s commitment to diversity and inclusion. These are behind a brand’s use of natural/clean ingredients, stance on animal testing, environmental credentials and lack of consideration for any of these factors.

“I personally am a believer in values-driven capitalism. And I think there is room for that,” said Kraber. “[But] the beauty and fashion industries are two of the hardest industries to have a successful values-driven company.”

Inside our coverage:

YouTuber Sydney Morgan dispenses wisdom for beauty brands.

How Jones Road avoided Black Friday discounting.

Not all brands have given up on CBD.

What we’re reading:

Four Amyris brands sold at auction.

Nexxus Capital Management takes MAV Beauty private.

Why brands struggle to offer personalized beauty.