Men’s grooming brand Hawthorne is breaking out of the DTC world.

In November, Hawthorne will expand to wholesale through 40 Nordstrom stores, Nordstrom.com, Candian retailer SSense and SSense.com. This news coincides with Hawthorne’s announcement of a $12 million Series B funding round led by Coefficient Capital, bringing the brand’s total funding to $22 million. The additional cash flow will finance distribution expansion. Hawthorne declined to state specific revenue or sales growth figures, but Brian Jeong, Hawthorne co-founder and CEO, confirmed that brand sales are in the eight-figure range.

“We’re trying to create premium products, but make them still accessible for everyday guys so that they can upgrade to better products and formulas,” said Jeong. “Part of achieving that and improving accessibility to our products is to expand distribution.”

The men’s grooming category has grown slowly but surely, with male customers becoming more sophisticated about the types of products they use and their grooming routines. According to Mordor Intelligence, the global men’s grooming market was worth $55.2 billion in 2020 and has a projected compound annual growth rate of over 4% for the next five years.

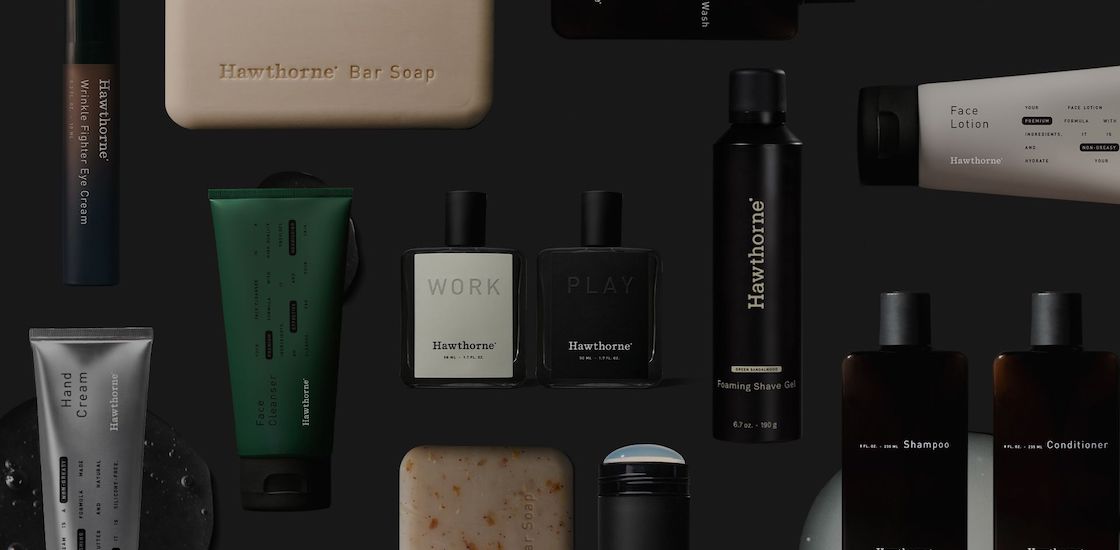

In 2020, Hawthorne leaned into skin care during a time when its hero franchise fragrance saw a downturn in sales, said Jeong. Though the cologne and perfume categories have since started to rebound from a Covid-19 slump, Hawthorne has continued to expand its portfolio away from fragrance and expand its brand equity. In the past four months alone, Hawthorne has launched five products, which marked its entrance into the shave and hair-styling categories. Its best-selling products are replenishable products like shampoo, conditioner and deodorant, but cologne continues to be the “largest” percentage of the brand’s revenue, Jeong said.

Because of this evolution, Hawthorne surveyed 100 customers online throughout 2021 to determine its current brand positioning. Because Hawthorne products address issues like thinning hair or dandruff, the brand adopted the tagline “confidently your best,” said Phil Wong, Hawthorne co-founder and creative director. The brand’s core customer demographic is men ages 25-45 in the Midwest and the Southern U.S.

“Heading into next year and 2023, we’re focused on bringing the brand to life,” said Wong. “With the pandemic, there has been a slowdown with in-person events and having a physical presence. Initially, we focused on the products, but now we want to tap into our customer archetype.” In October, Hawthorne held an in-store event at the New York City Nordstrom location, where it was offering a gift-with-purchase — a first for the brand.

Hawthorne has evolved its influencer and partnership network in 2021 to express this customer archetype, which Jeong described as “your friend who knows about clothes.” By working with people like fashion consultant Nick Wooster (@nickwooster; 883,000 Instagram followers) and promoting through men’s style podcast “Throwing Fits,” Hawthorne is trying to exude an attainable aspiration and an approachable aesthetic. Hawthorne currently has 46,500 Instagram followers, an increase of 18% since Jan. 2020.

To specifically support its retail expansion, Hawthorne is driving customers to SSense and Nordstrom through paid advertising on Facebook, Instagram and TikTok. Jeong said the cost-per-click on TikTok is as low as 50 cents, whereas with Facebook, SSense-focused ads run at about $1. However, TikTok’s attribution is not as sophisticated as Facebook’s. Hawthorne has increased its TikTok ad budget by 10x in the last month.